Why BTC Price is So Volatile and How to Navigate It

Bitcoin (BTC) has become one of the most talked-about assets in the financial world, captivating investors, traders, and analysts alike. However, despite its increasing mainstream acceptance and adoption, Bitcoin is known for its extreme price volatility. If you’re looking to invest in or trade Bitcoin, understanding why its price is so volatile—and how to navigate that volatility—is crucial. In this article, we will explore the factors that drive btc price swings and offer strategies to help you manage its volatility effectively.

What is Bitcoin and Why Does it Matter?

Bitcoin is the world’s first decentralized cryptocurrency, launched in 2009 by an anonymous entity known as Satoshi Nakamoto. Unlike traditional fiat currencies, Bitcoin is not issued by a central bank or government, and its value is determined by the market dynamics of supply and demand. Over the years, Bitcoin has gained widespread recognition as both a digital asset and a store of value, often referred to as “digital gold.” Its decentralized nature and limited supply—capped at 21 million BTC—are among the factors contributing to its appeal.

However, this appeal comes with challenges, primarily its price volatility, which can make it both an exciting and risky investment.

The Nature of Bitcoin’s Volatility

Bitcoin’s price volatility refers to the extent to which its price experiences fluctuations in a given period. This characteristic is a hallmark of Bitcoin and is one of the primary reasons why many investors find it both intriguing and dangerous. The volatility often results in large price swings—sometimes even within a single day—making Bitcoin an asset that requires careful consideration before entering the market.

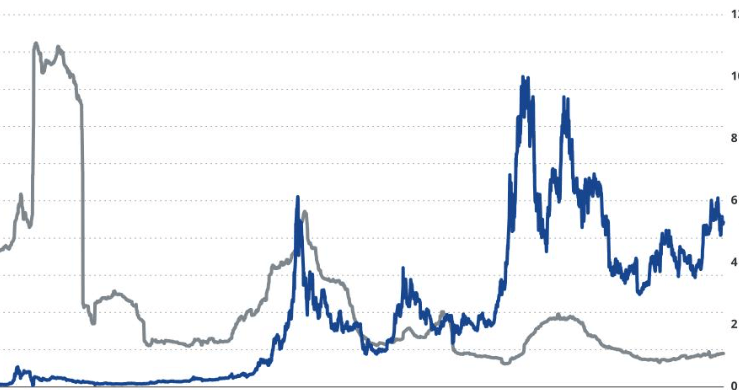

Historical Price Trends of Bitcoin

Since its inception, Bitcoin has experienced several significant price fluctuations. For instance, in 2017, the price surged from around $1,000 in January to nearly $20,000 by December, only to crash back down to about $3,000 in early 2018. More recently, during the COVID-19 pandemic, Bitcoin’s price hit new all-time highs, reaching over $60,000 before retreating back to lower levels. These dramatic price swings highlight just how volatile Bitcoin can be, making it a challenging asset for those seeking stability.

What Causes Bitcoin Price Volatility?

There are several factors that contribute to Bitcoin’s volatility. To better understand why this cryptocurrency experiences such drastic price changes, it’s essential to break down the key drivers.

Factors Driving Bitcoin’s Price Fluctuations

Market Sentiment

Bitcoin’s price is heavily influenced by market sentiment, which reflects how investors feel about its future prospects. Positive news, such as institutional adoption, mainstream acceptance, or favorable regulations, can drive prices upward. Conversely, negative news like government crackdowns, technological issues, or market crashes can lead to rapid declines. Market sentiment can be swayed by the actions of influential figures, including investors, regulators, and even celebrities, which means it can change quickly and unpredictably.

Regulation and Legal Factors

Regulatory uncertainty is a significant factor contributing to Bitcoin’s volatility. Many countries have different approaches to cryptocurrency, with some embracing it while others impose strict regulations or outright bans. Regulatory announcements—especially from powerful governments like the United States, China, or the European Union—can send shockwaves through the market. For instance, when China announced its crackdown on cryptocurrency mining in 2021, Bitcoin’s price dropped sharply. Similarly, the legal status of Bitcoin in various countries can either encourage or discourage investment, impacting its price.

Liquidity and Market Depth

Liquidity refers to how easily an asset can be bought or sold without affecting its price. Bitcoin is considered relatively liquid compared to other cryptocurrencies, but it still faces limitations. For example, large trades can cause significant price changes due to Bitcoin’s relatively smaller market capitalization compared to traditional assets like gold or stocks. When market depth is shallow, it only takes a small amount of capital to move prices, leading to higher volatility.

Macroeconomic Events

Global economic factors also play a crucial role in Bitcoin’s price fluctuations. Events such as economic recessions, financial crises, or inflation concerns can drive investors to seek alternatives like Bitcoin as a store of value or hedge. For instance, during periods of inflation, Bitcoin is often seen as a safeguard against the devaluation of fiat currencies. On the other hand, changes in global interest rates or stock market crashes can lead to a shift in investor sentiment, impacting Bitcoin’s price.

Technological Advancements and Issues

Bitcoin’s underlying technology, blockchain, is constantly evolving. Improvements to the Bitcoin network or the introduction of new features (like the Taproot upgrade in 2021) can influence investor perception and impact the price. On the flip side, technical problems such as network congestion or security breaches can lead to sudden price drops. As Bitcoin continues to develop, technological changes will remain a key factor in its price volatility.

The Role of Speculation in Bitcoin’s Price

Speculation plays a significant role in driving Bitcoin’s price. Many investors view Bitcoin as a speculative asset, hoping to profit from price movements rather than using it for transactional purposes. This speculative behavior can result in “pump-and-dump” schemes or herd mentality, where groups of traders collectively drive the price up or down based on emotions rather than fundamentals. As a result, price swings are often exaggerated, amplifying Bitcoin’s volatility.

How to Navigate Bitcoin Price Volatility

While Bitcoin’s volatility presents challenges, there are strategies to navigate it successfully. Whether you’re an investor or a trader, understanding how to manage the risks and opportunities associated with Bitcoin’s price fluctuations can help you stay ahead in this volatile market.

Risk Management Strategies

One of the most important strategies when dealing with volatile assets like Bitcoin is effective risk management. This involves setting stop-loss orders to limit potential losses, diversifying your investments, and only allocating a portion of your portfolio to Bitcoin. Risk management helps protect against significant losses while allowing you to capitalize on Bitcoin’s upward potential.

Hedging Against Bitcoin Volatility

Hedging is another useful strategy for managing volatility. By using derivatives such as Bitcoin futures or options, investors can protect themselves against price fluctuations. For instance, if you believe Bitcoin’s price will fall, you can take a short position in Bitcoin futures. Similarly, options allow you to set a price at which you can buy or sell Bitcoin in the future, providing a buffer against volatility.

Staying Updated on News and Market Developments

To navigate Bitcoin’s volatility, staying informed about the latest market news and developments is crucial. This includes tracking regulatory announcements, technological updates, and global economic events that could affect Bitcoin’s price. By understanding the factors influencing Bitcoin’s movements, you can make better-informed decisions about when to buy, sell, or hold.

Diversification and Long-Term Holding

One of the best ways to manage Bitcoin’s volatility is by diversifying your investments. While Bitcoin may be an essential part of your portfolio, balancing it with other assets—such as stocks, bonds, or real estate—can help reduce overall risk. Additionally, adopting a long-term holding strategy (also known as “HODLing”) can help you weather short-term price fluctuations while benefiting from Bitcoin’s long-term potential.

Conclusion

Bitcoin’s volatility is one of the defining characteristics that both attracts and deters investors. Understanding the factors that contribute to its price swings, such as market sentiment, regulation, liquidity, macroeconomic events, and speculation, can help you navigate this volatile market. By employing strategies like risk management, hedging, staying informed, and diversifying your portfolio, you can better manage Bitcoin’s volatility and potentially profit from its price movements.

FAQs

1. Why is Bitcoin’s price so volatile?

Bitcoin’s price is volatile due to factors like market sentiment, regulatory changes, liquidity, speculation, and global economic events. These factors can cause significant price fluctuations in a short period.

2. How can I manage Bitcoin’s volatility?

You can manage Bitcoin’s volatility by using risk management strategies like stop-loss orders, hedging with derivatives, staying informed on market news, and diversifying your investment portfolio.

3. What factors affect Bitcoin’s price the most?

The key factors affecting Bitcoin’s price include market sentiment, regulatory developments, liquidity, technological advancements, and macroeconomic conditions.

4. Is Bitcoin a good long-term investment?

While Bitcoin’s price is volatile, many investors view it as a long-term investment due to its potential as a store of value. However, it’s essential to manage risk and diversify your portfolio.

5. What are Bitcoin futures and how can they help with volatility?

Bitcoin futures are contracts that allow you to agree to buy or sell Bitcoin at a predetermined price in the future. They can help hedge against volatility by providing a way to protect against price declines.

6. Can Bitcoin’s volatility decrease over time?

Bitcoin’s volatility may decrease as it matures and gains wider adoption, but it will likely remain volatile due to factors such as speculation, regulatory developments, and macroeconomic changes.